Funding Process — “How Funding Works — A Simple 1-2-3 Process”

Step 1 — Apply or Submit Your Deal

Complete our online form or email your project information directly to

[email protected].

We will review the deal structure, numbers, and strategy.

Step 2 — Receive Terms & Underwriting Review

Once your deal is reviewed:

You will receive estimated terms

Underwriting will request documents

A POF letter can be issued if needed

Appraisal/title are ordered once approved

We strive for transparency, speed, and integrity.

Step 3 — Close & Fund Your Project

Once the file clears underwriting, we schedule closing.

Funds are wired to the title company, and you begin your project with confidence.

We support you from start to finish, ensuring your investment moves forward with clarity and

purpose.

Real Estate Funding Page

Real Estate Lending Solutions

Whether you are a seasoned investor or just beginning your journey, we offer funding options

designed to help you scale quickly and responsibly.

Real Estate Solutions We Provide:

- Private Money Lending

- Joint Venture Funding Solutions

- Commercial Loans

- Ground-up Construction Loans

- Bridge Loans

- Rental Loans

- Fix and Flip Loans

- Proof Of Funds

- Collateral DNA Reports

- Debt Stack Reports

- Leads in Your Market (leads off-market properties, ensuring a competitive edge by

avoiding saturation from other investors in your area)

Fix & Flip Loans

Competitive rates

Up to 75% ARV

Fast approval & closings

DSCR Rental Loans

Long-term rental financing

No income verification

Cash-flow based underwriting

Ground-Up Construction

Residential or small commercial

Flexible draws

Builder-friendly terms

100% Financing (JV Only)

Add this clearly:

“100% financing available ONLY through Joint Venture (JV) partnership.”

What is a JV Partnership?

“A Joint Venture (JV) is a partnership where both parties bring value to complete a real estate

project. You bring the deal and execution, and we bring the capital and support.”

Why JV With Paulas365 Capital?

Bad credit no problem

Lack of down payment

No experience needed (case-by-case)

We share the risk and reward

We help guide you through the process

You keep a portion of the profit without carrying the entire financial burden

Who Qualifies?

Ideal for:

New investors

Investors with great deals but limited liquidity

Experienced investors who want to scale faster

What Does Paulas365 Capital Provide in a JV?

100% purchase

100% rehab

Project oversight

Capital structure

Connections and resources as needed

Your Responsibilities:

Bringing a strong deal

Managing or overseeing renovations

Communicating updates

Operating with honesty and integrity

Structure:

Profit-sharing depends on deal size, scope, and responsibilities.

Terms are evaluated on a case-by-case basis.

Submit Your JV Deal:

Email your deal to [email protected] or complete the intake form.

Broker Partnerships:

“Paulas365 Capital welcomes brokers who wish to work with us for client financing

opportunities. We value long-term relationships built on transparency and mutual success.”

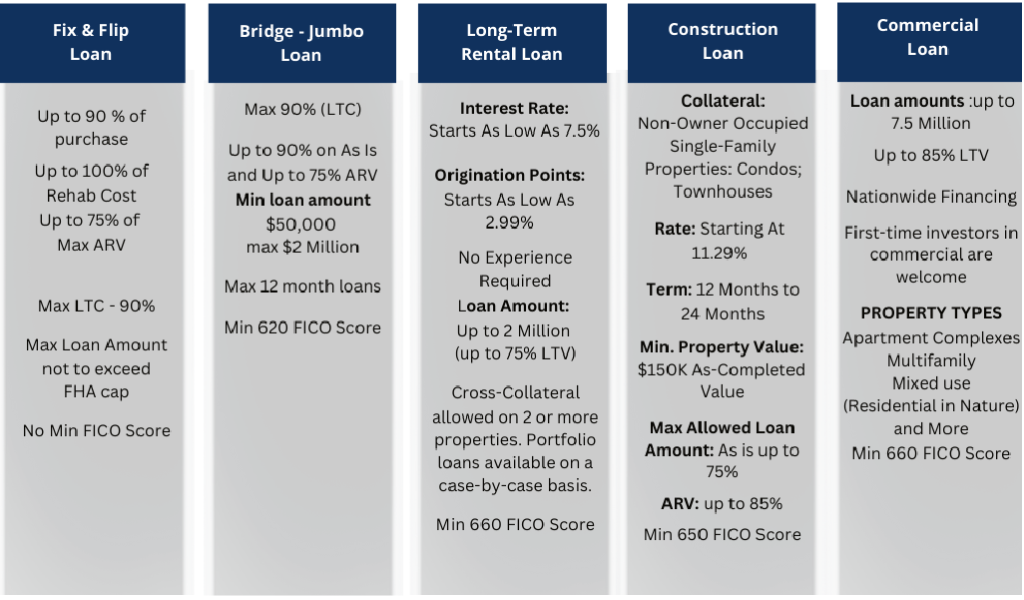

Types of Deals Paulas 365 Capital

Loan Terms

1. Max Loan Amount: Just Bring Us Your Deal! No cap on the loan amount if the numbers make sense. Rest assured; we will help you get it done. Call us today for more details. Paulas 365 Capital has funding solutions from $30,000 up to the FHA Cap in the county where the investment property is located and can provide additional lending solutions based on the property you have under contract and type of loan needed.

2. Rates: Current rates start at 7.5% annualized interest with an origination fee from 0-5%, and no prepayment penalties. (Rates are based on credit score but credit score does NOT determine loan approval.)

3. Loan Term: 6 Months to 2 Years for a fix & flip. 30 Years for a buy & hold or refinance. One loan approved per applicant until proven track record

Please complete the form below, and we’ll get in touch with you within 24 business hours to provide a no-obligation term sheet.